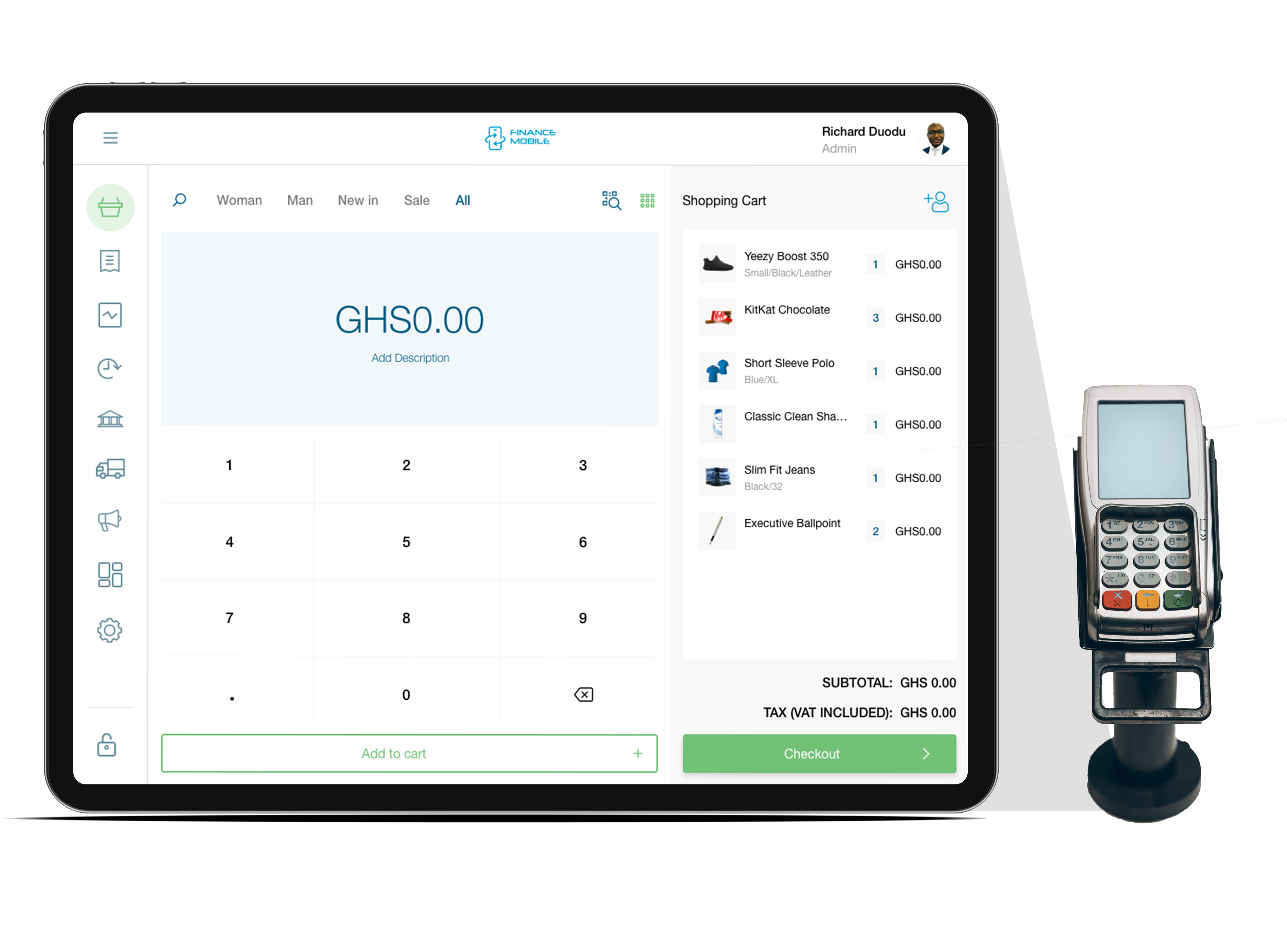

Modern financial services for Africa'sSmall Businesses.

Payment | Trade Finance | Commerce

How it works

Personalized banking for

Small Businesses.

Digitize your business with Billprompt and leverage the data it generates to access financial services.

Read MoreCreate physical and virtual cards.

Create physical and virtual cards that work globally with advanced payment security features like location-based payment and limits.

Unlock the full potential of your business.

With Billprompt trade finance, SMEs receive flexible B2B BNPL (Buy Now Pay Later) solutions to refinance their inventory, giving them the option to pay later and spread the costs of goods, making it easier to manage their cash flow and increasing their purchasing power.

This empowers our SMEs with direct access to financing for their operational purchasing needs.

Read More

Sell More, Sell Faster.

SMEs can access weekly incremental credit, with amounts ranging from GHS 1,000 to GHS 5,000, specifically designed for inventory financing.

Uncover previously inaccessible data within the informal retail economy.

This enables informal merchants across Africa to access new lines of business, credit, and savings services— all without the need to visit a bank branch or step away from their points of sale.

With transaction data analysis on the Billprompt platform, micro-merchants' creditworthiness is more accurately evaluated, opening the door for many to access working capital loans for the first time.

For these merchants, this translates to a boost in ongoing trade, an increase in returning customers, and the opportunity to sell additional goods and services.

Gain access to capital for inventory refinancing, enjoying the convenience of deferred payments.

Pay and accept payment from anyone, anywhere in the world.

One super app for all your financial needs.

Join Billprompt Today.

At Finance Mobile, we're transforming the financial landscape for local businesses on the streets of Africa. Our branchless digital bank offers mom-and-pop shops direct access to capital, allowing them to refinance their inventory with the convenience of deferred payments. This means they can easily spread the costs of goods, effortlessly manage cash flow, and ultimately, enhance their purchasing power.